30 Jul 2024 PGF Capital sees record profit on new Aussie insulation rules, data centre cooling needs

Source: https://theedgemalaysia.com/node/719993

This article first appeared in The Edge Malaysia Weekly on July 22, 2024 – July 28, 2024

PENANG-based insulation products maker PGF Capital Bhd (KL:PGF) is poised for a record-breaking profit this year. Already operating at full capacity, the company, which is seeing greater demand for insulation products in Malaysia from data centre cooling needs, also expects to benefit from new insulation regulations in Australia.

PGF CEO and major shareholder Fong Wern Sheng emphasises that in Australia, every building is required to have insulation. Additionally, the Australian government updates the country’s building code every three years to enhance the star rating of homes.

“When you buy an air conditioner, you will see different star ratings because each of them has a particular energy efficiency ratio. It is the ratio of the amount of heat removed in an hour to the power consumed in an hour.

“Similarly, countries like Australia have star ratings for their houses. The higher the star rating is, the more insulation — which is our product — that has to be used,” he tells The Edge in an interview.

Fong says effective May 1 this year, Australia’s required star rating was increased to 7-star from 6-star previously. In three years, it will be upgraded to 8-star. New Zealand implemented similar measures last year.

Headquartered in Perai, Penang, PGF is mainly involved in manufacturing glass mineral wool insulation and property development. Some 80% of its raw material is recycled glass, collected from construction sites and glass processors throughout Malaysia.

Headquartered in Perai, Penang, PGF is mainly involved in manufacturing glass mineral wool insulation and property development. Some 80% of its raw material is recycled glass, collected from construction sites and glass processors throughout Malaysia.

“They [construction sites] purchase big pieces of glass to produce windows or doors. They have to cut and trim, so they have glass waste and damaged products. You could say we are like a glass recycling company. The other source of recycled glass is solar panel manufacturers, as some of their products have defects. We also collect the end-of-life solar panels for recycling,” says Fong.

He adds that most of PGF’s raw materials are free because they are basically glass waste.

“In about five years’ time, I expect an influx of solar panel waste as the panels approach end-of-life cycles. We can use the glass content from these panels as our raw material input. By then, we can even build a new income stream by collecting payment to accept the panels as they are a form of scheduled waste that cannot be sent to the landfill.”

Fong recalls that a few years ago, PGF was selling its products to many countries, such as in Europe and North America, including all the way to Halifax, Canada.

“We were spreading ourselves too thin at the time. When the Covid-19 pandemic happened, our whole team sat down and decided to change our strategy to focus on countries with high growth potential that could provide us good profit margins.”

Following that, PGF shifted its focus to mainly Australia and New Zealand, followed by Malaysia and Singapore.

“Obviously, Malaysia is our home ground and Singapore is our neighbouring country. And what we like about Australia and New Zealand is that the insulation material is compulsory in their building code,” Fong explains.

The Australian federal government targets to build 1.2 million new houses over the next five years, and has announced A$3 billion (RM9.4 billion) in incentives to states and territories to do so.

“This provides tremendous opportunity for companies like us,” he says.

Besides Australasia, certain European countries are also very stringent about their building codes and energy-saving measures. Fong acknowledges, however, that the shipping costs to Europe would be too high and would eat into PGF’s profit margin.

“There are no plans to look into the European markets at the moment. After all, our Perai plant is already operating at maximum capacity. Based on the statistics that we gathered, Australia needs 140,000mt (metric tons) of insulation products every year. Our market share in the Australian market is only about 6% now. We target to increase it to 20% over the next few years,” he says.

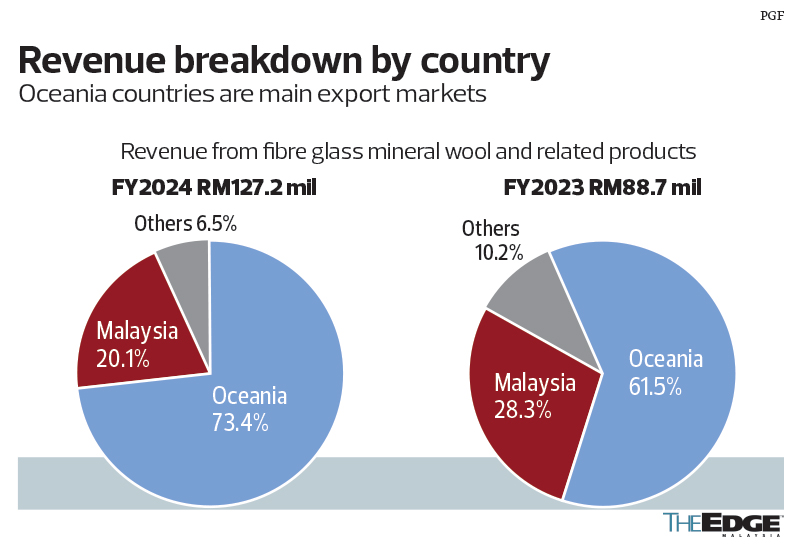

Overall, the Australia and New Zealand markets contribute about 70% of PGF’s revenue, while the rest comes from Malaysia and Singapore.

The fact that its plant is experiencing its busiest streak now boosts Fong’s optimism that the financial year ending Feb 28, 2025 (FY2025) will be a record-breaking one for PGF in terms of profit.

“In fact, if everything goes well, we believe all four quarters in FY2025 could break their previous corresponding quarterly records. The simple reason is because this is the first time that we have been consistently running at full capacity since late last year.”

Fong was appointed to the board of PGF as an executive director in 2003, before he was redesignated as executive chairman in 2017. The 43-year-old, who assumed his current role of CEO in May last year, is the second largest shareholder of PGF with a direct stake of 5.95% and indirect stake of 13.05% held via Green Cluster Sdn Bhd.

His father, Fong Wah Kai — the company’s executive chairman — is the single largest shareholder with 39.28% equity interest, held through Equaplus Sdn Bhd. The 77-year-old also owns a direct stake of 3.74%.

PGF’s net profit declined by 36% to RM10.5 million in FY2024, from RM16.3 million in FY2023. As at Feb 29 this year, the company’s net gearing stood at 0.02 times. It had cash and cash equivalents of RM26.1 million and total loans and borrowings of RM29.5 million.

It is worth noting that PGF made a quarterly loss of RM2.25 million in the fourth quarter (4QFY2024), mainly due to the reversal of a grant received amounting to RM5.76 million that was recognised in 2QFY2024.

On advice from the auditor, the grant will now be recognised as deferred income over the remaining useful life of the upgraded plant and machinery of eight years.

Building a second plant in Kulim

Formerly known as Poly Glass Fibre (M) Bhd, the company was listed on the Second Board in 1990 before migrating to the Main Market of Bursa Malaysia in 2009.

PGF currently operates one manufacturing plant in Perai, and has four distribution hubs in Australia.

To cater for stronger demand from the Oceania markets, Fong says the group is planning to expand its annual production capacity by 175% to 68,800mt, by building a second plant in Kulim, Kedah.

“We are in the midst of purchasing a 25-acre land in Kulim, which is about half an hour away from our existing plant in Perai. We have identified the land but we are still in negotiations to finalise the deal.

“The reason we want to build a new plant in Kulim is because we are export-based and the site is only about 30 to 35 minutes from the Port of Penang.”

Fong says PGF’s existing plant in Perai has a production capacity of 25,000mt per year, while the Kulim plant is targeting to produce about 43,800mt a year.

The group has allocated capital expenditure of RM200 million for the expansion project in Kulim, including land, building and machinery.

“Once we complete the land acquisition in Kulim, hopefully by this year, we would probably need another 18 months to construct the new factory,” he adds.

While Malaysia currently does not have a star rating for residential houses, Fong notes that the government is working towards that as the country has a carbon-neutrality target of 2050.

In October last year, parliament passed the Energy Efficiency Conservation Act, which requires commercial and industrial buildings of certain sizes to implement energy-saving measures and to be subject to periodic energy audits.

“So far, unlike Australia, Malaysia has yet to implement similar measures for the residential part. But the influx of FDI (foreign direct investment) in Malaysia is already creating a lot of opportunities for us in the industrial space.

“That’s because the MNCs (multinational corporations) are generally very stringent about their building code. If you look at some of the European and American companies, their insulation requirements are higher than our Malaysian standard,” he points out.

Year to date, shares of PGF have gained 76% to close at RM2.31 last Friday, giving the company a market capitalisation of RM447.95 million. The counter is currently trading at a historical price-earnings ratio of 41 times.

On July 17, PGF said its wholly-owned subsidiary PGF Global Distribution Sdn Bhd had signed a five-year agreement with Centria Building Material Manufacturing (Shanghai) Co Ltd that gives it exclusive rights to distribute the Chinese company’s mineral wool sandwich panels or thermal insulated panels in Malaysia. The panels “offer excellent thermal performance, crucial for maintaining optimal temperatures in data centres, which helps in reducing cooling costs and energy consumption”, PGF Capital said in its statement to the stock exchange.

Agrotourism project work in progress

Besides its bread-and-butter insulation business, PGF also owns a sprawling 1,311.15-acre tract of land in Tanjung Malim, Perak, which lies adjacent to the Automotive High-Tech Valley (AHTV) in Proton City — an automotive hub that is set to receive a massive US$10 billion (RM46.8 billion) investment from China’s auto giant Zhejiang Geely Holding Group Co Ltd.

Capitalising on the potential, PGF has been crafting an ambitious 10- to 15-year master plan to develop a self-sustaining, agrotourism-themed integrated township, dubbed Diamond Creeks Country Retreat, on the land.

“We remain very excited about our master plan for the Diamond Creeks Country Retreat project as the Geely chairman (Li Shufu) had reportedly said he plans to bring the whole supply chain into the AHTV.

“We understand Geely will promote the localisation of Malaysia’s auto parts industry by introducing advanced global auto parts companies into the market and strengthening cooperation with local suppliers,” Fong says.

PGF had in March 2024 received rezoning approval for its land from mostly agriculture to residential. The acreage for residential land is now 577 acres, up from 72 acres previously.

“The rezoning is in line with the Mualim District Local Plan 2035. We have submitted our documents to apply for Kebenaran Merancang (KM) for the phase 1 property development project, and we expect to receive the approval within the next few months. Once we get it, then we can start work for our Phase 1,” he says.

For Phase 1, which will span 45 acres, PGF’s plan is to undertake an outright land sale to a private developer, Malvest Properties Sdn Bhd, which will develop about 1,800 units of residential and commercial properties with an estimated gross development value of RM600 million. By doing so, PGF will be able to recognise a one-off gain over FY2025 and FY2026.

From Phase 2 onwards, PGF will own a 51% stake in a new joint-venture (JV) entity, while Malvest will hold the remaining 49% stake. With this model, not only would PGF profit from the land sale to its 51%-owned JV firm, but it would also profit from the development of the land.

A look at PGF’s 2024 annual report shows that the Diamond Creeks Country Retreat land was acquired by the company in 1997. The land is under a lease that expires in 2095 and has a carrying value of RM148.055 million, which translates into only about RM2.60 psf.

The last revaluation was done in FY2023. Based on accounting standards, PGF could only value the land at the lower of cost or net realisable value as it is classified as land held for property development and not investment property.